Some Ideas on Medigap Agent Near Me You Need To Know

Wiki Article

Not known Factual Statements About Medigap Agent Near Me

Table of ContentsSome Known Factual Statements About Medigap Agent Near Me The Medigap Agent Near Me DiariesMedigap Agent Near Me Can Be Fun For EveryoneFacts About Medigap Agent Near Me UncoveredHow Medigap Agent Near Me can Save You Time, Stress, and Money.

These activities might include marketing, modern technology, training, and also conformity; the companies act as an intermediary between agents and also insurers. Unlike registration compensations, administrative payments are not established by any kind of governing or regulative body; instead, they are set by insurance providers in negotiation with each independent firm. For MA as well as Part D, CMS's Medicare advertising and marketing guidelines develop that these repayments "must not go beyond FMV or an amount that is commensurate with the quantities paid to a third event for similar services throughout each of the previous 2 years." These repayments supply one more channel of financial backing between insurance companies and also companies and representatives.

, agent compensation (a percent of the costs) additionally has actually reduced. Our analysis has 4 core ramifications for policymakers.

Medigap Agent Near Me for Dummies

g., growth of a specific MA product over one more, or growth of MA organization over Medigap). This could develop an additional dispute of rate of interest. Enhancing transparency and also reporting on service providers' actual compensation repayments instead of the CMS-defined maximums across MA, Part D, and also Medigap could assist resolve this. Policymakers likewise need to think about additional regulative quality around the administrative payments, rewards, and also various other types of settlement.MA and also Part D strategies are measured with the celebrity scores program and also are compensated in different ways for providing a top notch member experience. Pay-for-performance can be taken into consideration part of the compensation model for representatives and companies. And 4th, the renewalcommissions version is a double-edged sword. Guaranteeing compensations also if beneficiaries stick with their initial strategies might help stop unneeded switching.

Policymakers can consider defining a minimum level of service needed to make the revival or switching compensation. Representatives are a vital source for recipients, yet we need to reimagine settlement to make certain that incentives are much more very closely lined up with the purposes of providing guidance as well as advise to beneficiaries and also without the threat of contending economic passions.

Medigap Agent Near Me for Beginners

It prevails for people looking for a brand-new medical insurance plan to experience an insurance policy agent, but is this needed when it pertains to Medicare? The situation will vary depending on the sort of Medicare you want. If you do choose to go with an agent, the information can still make the procedure differ widely.If you're simply planning to register navigate here in Original Medicare (Medicare Parts An and B), after that you won't require to make use of an insurance coverage agent. You will not be able to utilize an insurance policy agent-- this kind of Medicare is just offered from the federal government. Insurance coverage agents will never come into the image.

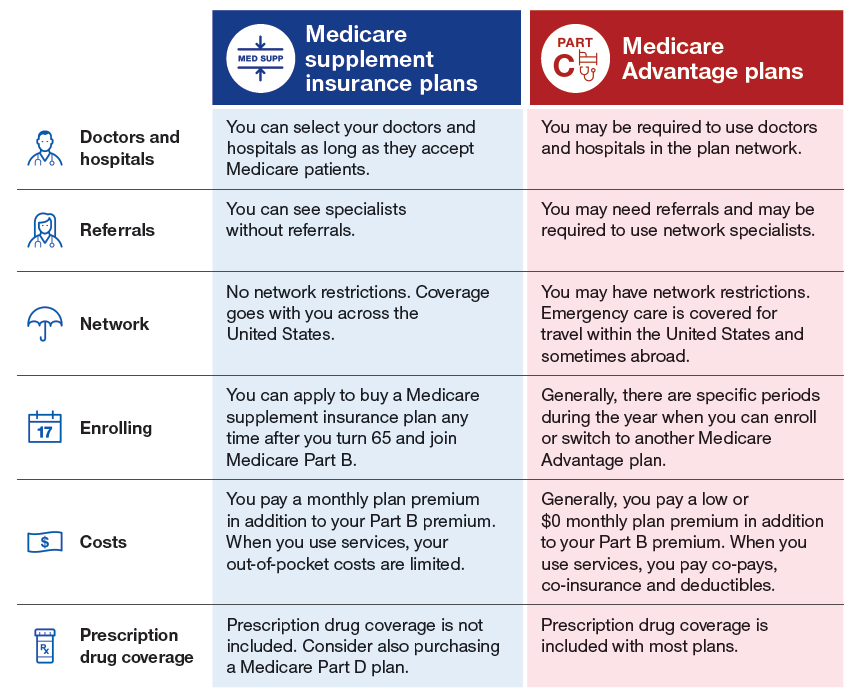

This is because Part D strategies are marketed by private insurance policy companies. Medicare Advantage is by much one of the most common type of Medicare insurance coverage that is marketed through insurance coverage agents. Medicare Benefit plans, additionally known read this article as Component C strategies, are essentially a method of obtaining your medical care coverage through an exclusive strategy.

Medigap Agent Near Me Things To Know Before You Get This

Some Component C plans included prescription medicine plans bundled with them, as well as some don't (Medigap Agent Near me). If yours does not featured a PDP, after that it can be possible to get Component C from one firm and also Part D from another, while collaborating with 2 different agents for each strategy. Medicare Supplement intends, likewise referred see it here to as Medigap plans, are plans that cover out-of-pocket expenses under Medicare.These strategies are also marketed by personal insurance provider, which means that insurance policy agents will have the ability to market them to you. When it pertains to Medicare insurance policy representatives, there are generally two kinds: captive as well as independent. Both can be certified to market Medicare. "captive" has an extremely negative undertone, it is simply used to refer to representatives who function for only one firm, rather than representatives who can work with a range of insurance companies.

The basic manner in which you can think about captive versus independent representatives is that restricted agents are sales reps who are contracted to sell a particular insurance policy product. Independent representatives, on the other hand, are much more like insurance policy brokers, indicating that they can offer you any type of sort of insurance item, and aren't restricted to one business - Medigap Agent Near me.

5 Simple Techniques For Medigap Agent Near Me

By doing this, you can think of them as analogous to an automobile salesman; they offer one type of item for one firm, and probably are paid by means of compensation. Independent representatives are merely individuals who market insurance-related products. They can offer an insurance policy plan from Company A to someone and Business B to another, which is something captive representatives just can not do.As you can imagine, there is a much greater degree of flexibility that includes dealing with an independent insurance coverage agent instead of a captive one. Independent representatives can consider every one of the insurance coverage items they have access to as well as look for the one that functions best for you, while captive agents can only sell you one details point, which may not be a good fit.

Report this wiki page